March 2018 Edition

In this edition:

MYOB updates

Account Right 2017.2 is now available

Single Touch Payroll:

Single Touch Payroll is an electronic method for reporting your employees' payroll information to the ATO at the same time you pay your employees.

As a result, businesses will no longer be required to complete payment summaries at the end of the financial year as it will have already been done and available to employees through myGov. You will report your employees' payroll information (including salaries, wages, PAYG withholding, and super information) directly to the ATO from your payroll solution.

"You will need to discuss with your employees the importance of setting up a myGov account if they don't already have one". Create an account.

Single Touch Payroll will be mandatory from 1 July 2018 for businesses with 20 or more employees. If you're not using a MYOB product and need to be STP compliant, make sure to ask your vendor what steps they are taking to update your product.

Single Touch Payroll functionality will be delivered into MYOB products throughout the first half of 2018. Your first mandatory step is to conduct a headcount of your employees on 1st April 2018. If you have 20 or more employees on this date, STP will be mandatory for your organisation. If not, then you can volunteer for this more streamlined reporting process.

How to lodge a Simpler BAS

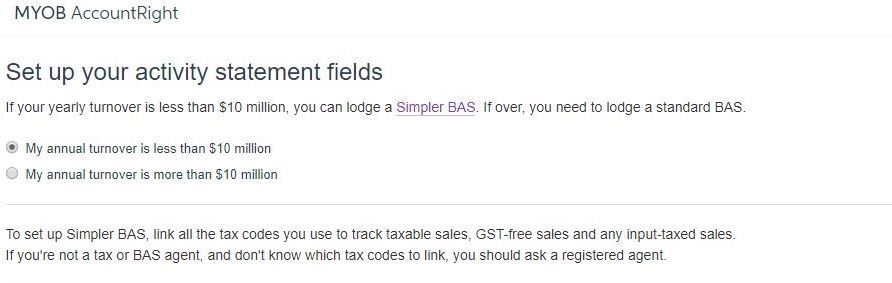

With simpler BAS reporting, if your turnover is less than $10 million per year, you are only required to report total sales(G1), GST on sales(1A) and GST on purchase(1B).

If your company file is online, you can lodge a Simpler BAS online. When setting up your activity statement fields for the first time, you'll be asked if your annual turnover is less than $10 million. If it's less, you'll be shown the Simpler BAS layout to fill out, otherwise all the fields required on the standard BAS will need to be completed.

If you've already set up the online activity statement, we'll automatically show you the Simpler BAS form if the ATO lets us know that you're eligible to use it.

If your company file isn't online, you can use MYOB BASlink to prepare your Simpler BAS. While BASlink is designed to help you complete a standard BAS form, you can still use the amounts it gives at G1, 1A and 1B fields for your paper or ATO portal forms to lodge your Simpler BAS.

If you wish to discuss please don't hesitate to contact our offices for more information.

Contact details

Suite 401 29-31 Solent Circuit

Norwest Business Park

Baulkham Hills, NSW 2153 Australia

View location map

P:

(02) 9899 3044

F: (02) 9899 1524

About Us

Our Team Members are the heart and soul of our business. Our team's guiding principles are integrity, respect, teamwork, achievement and innovation. Our guiding principles are the keys to our culture and to achieving our vision.

Resources

We offer a range of free and easy to use

online resources and tools including...