March 2018 Edition

In this edition:

SMSF investments in cryptocurrencies

The focus on cryptocurrency investments is being closely examined as it becomes more and more popular especially for investors asking whether it is a legitimate investment in SMSFs.

It is important to ensure that investing in Cryptocurrencies is covered under the SMSF governing rules and that it is allowable under the investment strategy.

The ATO view is that this type of investment is not classified as money and should be acquired through a reputable exchange and under no circumstances be acquired from its members.

Therefore, if you want to buy Cryptocurrencies as an investment for your self-managed super fund, then you need to ensure that:

1) Cryptocurrencies are purchased in the name of your fund.

Under no circumstances should Cryptocurrencies be purchased in the name of an individual SMSF member. It is a legal requirement for the trustees of self-managed super funds to separate the fund's assets from its individual members' personal assets. This will ensure that the Cryptocurrencies investment satisfies the sole purpose test of SMSFs that is to provide retirement needs for their members. Failure to satisfy this sole purpose test can lead to severe penalties, including fines and the loss of your self-managed super fund's tax concessions.

Ideally, proceeds of the sale of any Cryptocurrencies should be transferred to your self-managed super fund's bank account and that you declare any profit or loss you have made as part of your fund's annual reporting.

2) Your SMSF trust deed has no restrictions on investing funds in assets like cryptocurrencies.

Your SMSF trust deed must include Cryptocurrencies investments. As Cryptocurrencies are part of a relatively new asset class, it is unlikely that most SMSF deed would include a provision for investing into these currencies.

3) The investment complies with your self-managed super fund's diversified investment strategy.

Before you start making investments you must have an investment strategy. It's a legal requirement for SMSFs to have an investment strategy. Your fund's compliance with this strategy is one of the things that is checked as part of your annual self-managed super fund audit.

4) Make your fund's auditor aware of the investment.

It is a legal requirement for your self-managed super fund to be audited each year. Cryptocurrency assets are valued at the prevailing market rate at the end of each financial year.

5) Your SMSF does not acquire Cryptocurrencies from one of its members or a related party.

All self-managed super funds must be arm's length transactions.

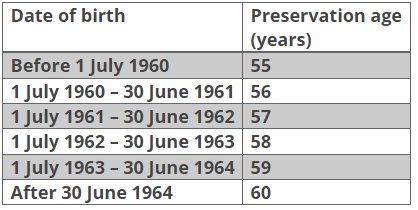

Furthermore, it's also important to remember that an SMSF Cryptocurrencies investment is just like any other superannuation investment. You won't be able to access it until your reach your preservation age. The most common superannuation condition of release is retirement, provided you have reached your preservation age. This age depends on your date of birth, as outlined in the table below:

Should you have any questions or require further clarifications regarding self-managed super funds' investments in cryptocurrencies, please don't hesitate to contact us on (02) 9899 3044 or email: sozana@goodwinchivas.com.au.