July 2014 Newsletter

In this edition:

What changed on 1 July 2014

Changes to Super Guarantee, Medicare Levy and more

The start of July also brings a new financial year, and with it a number of regulatory changes.

Here is a brief summary of the key changes that commenced on 1 July 2014:

Superannuation Guarantee Increased to 9.5%

As was previously legislated, from 1 July 2014 the Superannuation Guarantee rate increased from 9.25% to 9.5%.

This rate effects superannuation paid on ordinary times earnings – generally salaries and wages earned by employees.

It is proposed that the rate will stay fixed at 9.5% for the next four years, before rising by 0.5% per annum, reaching 12% on 1 July 2023.

Medicare Levy Increased to 2%

The Medicare Levy has increased from 1.5% to 2% from 1 July 2014.

Temporary Budget Repair Levy Introduced

In the recent Federal Budget, the Government announced a new "levy" on taxpayers earning more than $180,000 a year.

The levy is charged at 2%, and will only apply to income over the $180,000 threshold (not all taxable income). It is proposed to be a temporary charge only, and is proposed to apply from 1 July 2014 to 30 June 2017.

This increase, together with the increase in the Medicare Levy, takes the effective top marginal tax rate from 46.5% to 49%.

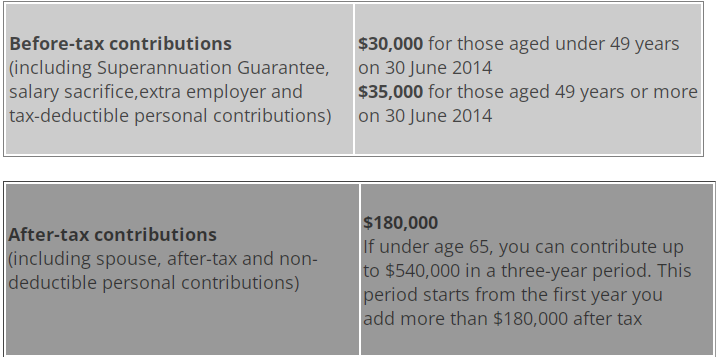

Changes to Super Contribution Limits

The amount that can be contributed to super has changed.

For the 2014/15 year, the superannuation limits are as follows:

Government Co-Contribution Threshold

The threshold for eligibility for the Government Superannuation co-contribution has increased to $49,488 for the 2014/15 year.

Taxpayers earning less than this amount who make non-concessional superannuation contributions may be eligible for a Government co-contribution to super of up to $500, tax free.

Contact details

Suite 401 29-31 Solent Circuit

Norwest Business Park

Baulkham Hills, NSW 2153 Australia

View location map

P:

(02) 9899 3044

F: (02) 9899 1524

About Us

Our Team Members are the heart and soul of our business. Our team's guiding principles are integrity, respect, teamwork, achievement and innovation. Our guiding principles are the keys to our culture and to achieving our vision.

Resources

We offer a range of free and easy to use

online resources and tools including...