May 2021 Budget Update

In this edition:

May 2021 Budget Update - For Individuals

Personal tax relief - extension of tax offset

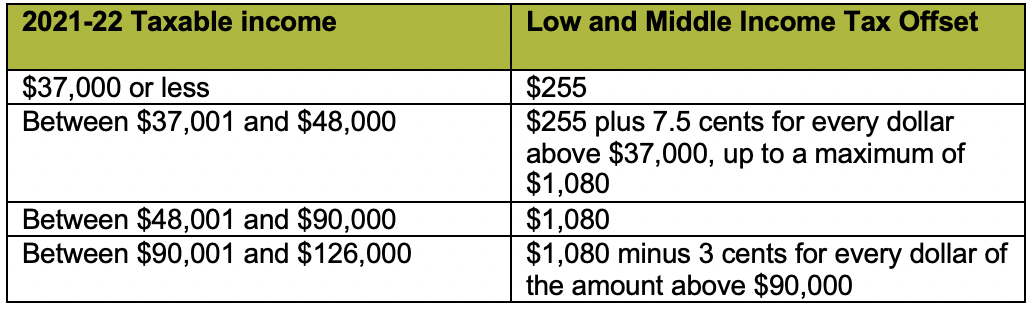

The Low and Middle-Income Tax Offset (LMITO), worth up to $1,080, has been extended for an additional 12 months to cover the 2021/22 financial year. LMITO will be received once individuals lodge their tax return for the 2021/22 financial year.

The table below shows the amount of offset an individual client is entitled to depending on their taxable income:

Home ownership proposals

1. First Home Super Saver Scheme (FHSSS)

The FHSSS, which was introduced in the 2017/18 Budget, allows people to save money for their first home inside their super. The Government will increase the maximum amount of voluntary contributions that can be released under the FHSSS from $30,000 to $50,000.

2. Family Home Guarantee for single parents

The Government has introduced the Family Home Guarantee as a way of providing a pathway to home ownership to support single parents with dependants. This is regardless of whether they are a first home buyer or a previous owner-occupier.

From 1 July 2021, 10,000 guarantees will be made available over four years to eligible single parents with a deposit of as little as 2%, subject to an individual's ability to service a loan.

3. New Home Guarantee

The Government is providing a further 10,000 places under the New Home Guarantee in 2021/22. This is specifically for first home buyers seeking to build a new home or purchase a newly built home with a deposit of as little as 5%.

New bright-line test for individual tax residency

The government will replace the individual tax residency rules with a new, easier to understand framework that provides certainty and reduces compliance costs for globally mobile individuals and their employers.

The primary test will be a simple 'bright line' test: a person who is physically present in Australia for 183 days or more in any income year will be an Australian tax resident.

Individuals who do not meet the primary test will be subject to secondary tests that depend on a combination of physical presence and measurable, objective criteria

If you have any questions, please contact us.

Contact details

Suite 401 29-31 Solent Circuit

Norwest Business Park

Baulkham Hills, NSW 2153 Australia

View location map

P:

(02) 9899 3044

F: (02) 9899 1524

About Us

Our Team Members are the heart and soul of our business. Our team's guiding principles are integrity, respect, teamwork, achievement and innovation. Our guiding principles are the keys to our culture and to achieving our vision.

Resources

We offer a range of free and easy to use

online resources and tools including...