September 2019 Edition

In this edition:

Extension and increase to the instant asset write-off

The popular instant asset write-off for small business has been extended and increased. The new laws:

- Increase the threshold below which small business entities can access an immediate deduction for depreciating assets and certain related expenditure (instant asset write-off) from $25,000 to $30,000 effective form 2 April 2019; and

- Enable businesses with aggregated turnover of $10 million or more but less than $50 million to access instant asset write-off for depreciating assets and certain related expenditure costing less than $30,000.

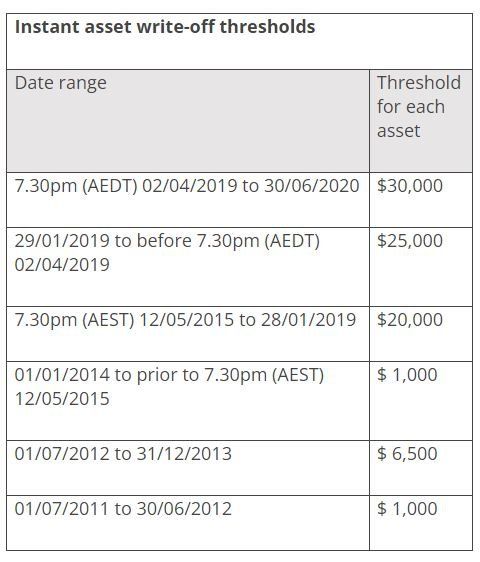

The threshold has changed over the last few years and during the financial year 2019 as shown in the table below.

Assets will need to be used or installed ready for use between budget night and 30 June 2020 to qualify for the higher threshold. Items purchased but not installed ready for use by 30 June 2020 will not qualify.

The instant asset write-off only applies to certain depreciable assets. There are some assets, like horticultural plants, capital works (building construction costs etc.) or assets leased to another party on a depreciating asset lease that don't qualify.

If you need assistance to ensure you are making the most of the instant asset write-off, please contact us.