June 2018 Edition - End of Financial Year Guide

In this edition:

Top tips for End of Financial Year planning

1: BUDGET ANNOUNCEMENTS RECAP

The key announcements from the 2018 Federal Budget that may have an impact for year-end tax planning include:

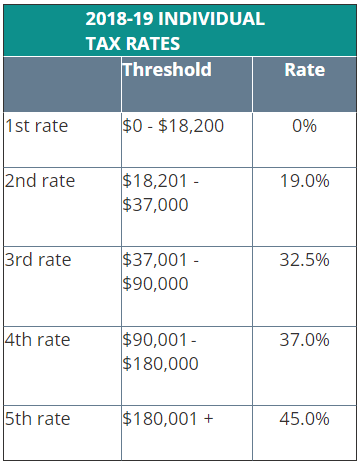

Tax Rates for Individuals

The Government announced an intention to provide tax cuts for selected individuals from 1 July 2018. These cuts will be provided in two forms:

- Increase in the threshold between the 32.5% and 37% rates from $87,000 to $90,000

- A new Low and Middle Income Tax Offset providing a benefit of up to $200 for individuals earning under $37,000 and up to $530 for individuals earning between $48,000 and $90,000. The offset reduces by 1.5 cents for every dollar in excess of $90,000 (finally cancelling out at $125,333).

Instant asset write off

The Government announced an intention to extend the $20,000 instant asset write off for an additional 12 months, ending on 30 June 2019. The scheme was initially legislated to end on 30 June 2018. The instant asset write off is available to small business entities that are carrying on a business and have an aggregated turnover less than $10 million.

2: KEY CHANGES FOR 2018

GST and new residential property

From 1 July 2018, purchasers of new residential premises and certain residential land may be required to remit the GST payable on the sale of the premises or land directly to the Tax Office, rather than paying the GST to the vendor of the premises/land.

Vacancy tax

Non-resident (foreign) owners of residential property acquired after 9 May 2017 will be required to pay a vacancy tax where the property is not occupied or available for occupation (by rental) for half of the relevant year. The year is measured as 12 months from the acquisition date of the property.

All foreign owners of residential properties acquired after 9 May 2017 are required to lodge a vacancy tax return with the Tax Office, irrespective of whether the property is vacant or not. The first returns will be due for lodgement within the next 12 months.

Main residence CGT exemption

Legislation has been introduced into Parliament to deny the main residence CGT exemption where the taxpayer selling the property is a non-resident at the time of the sale. These changes take effect from 9 May 2017, although transitional provisions will extend the exemption until 30 June 2019, for properties held on 9 May 2017.

Individual tax rates

In addition, the Medicare levy is 2% of taxable income. Therefore, the top marginal tax rate for resident individuals will be 47% (including Medicare levy).

A new Low and Middle Income Tax Offset will also be available, providing a benefit of up to $200 for individuals earning under $37,000 and up to $530 for individuals earning between $48,000 and $90,000. The offset reduces by 1.5 cents for every dollar in excess of $90,000 (finally cancelling out at $125,333).

As noted above, the proposed tax cuts to take effect from 1 July 2018 may make it attractive for smaller taxpayers to defer deriving income until after 1 July 2018 in the event they may be able to take advantage of the small tax cuts. Caution should be exercised as the derivation rules may prevent the income from being deferred. Also, the tax cuts have not been legislated, so you may not be able to rely on their immediate availability.

Small business

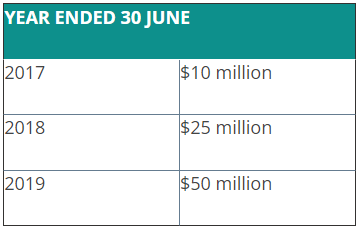

From 1 July 2016, the income tax rate applicable to companies carrying on a business was reduced to 27.5%. The reduction will progressively apply to companies based on their aggregated turnover in the years in question.

To clarify which companies are carrying on a business for the purpose of these provisions, the Tax Office has released a draft ruling (TR 2017/D7). The 27.5% tax rate will apply to companies as follows:

3: YEAR END PLANNING

Director penalties

Company directors should review their companies' reporting mechanisms to ensure they are adequately informed of their companies' financial position. The director penalty provisions may leave directors personally liable where their company fails to make PAYG Withholding and SGC payments by the respective due dates.

Defences against director liabilities include situations where the director has been ill, has taken all reasonable steps to ensure the outstanding liabilities have been paid, or in limited circumstances the director has been appointed to the company in the last 30 days. However, good evidence will be required for these defences.

Loans - Division 7A

Loans made by private companies to their shareholders or associates will be treated as deemed dividends under Division 7A unless the loan is repaid by the earlier of the date of lodgement or due date for lodgement for company's tax return for the year, or the loan is converted to a formal loan with the following features:

- Is under a Division 7A complying written agreement and on commercial terms by the earlier of the company's lodgement day or due date

- Has a minimum benchmark interest rate

- Has a term of no more than seven years, or 25 years for registered mortgages over real estate.

Other Important Division 7A issues:

- Ensure minimum loan repayment amounts are paid in years after the loan is made; any shortfall will be a deemed dividend in that year

- A Division 7A deemed dividend is generally unfranked

- Payments and debt forgiveness to a shareholder or associate can also be a deemed dividend

- The private use of company owned assets for less than market value consideration can be a deemed dividend under Division 7A

- These rules apply to shareholders and associates, which includes relatives of shareholders and trusts, companies and partnerships of the shareholders or their associates

- There is a Commissioner's discretion for non-complying loans not to be treated as a deemed dividend or to be treated as a franked dividend if it resulted from an honest mistake or inadvertent omission

- Loans for income producing purposes can be caught as a deemed dividend under Division 7A – there is no otherwise deductible rule

- Make sure all Division 7A loans made in the 30 June 2017 tax year were either repaid or put under a complying Division 7A loan agreement by the earlier of the lodgement date or due date of the company's 2017 tax return

- If the company has an unpaid present entitlement from a trust, it may be a deemed dividend to the trust and/or the shareholder or their associate in some circumstances (see comments under 'Trusts' below).

Superannuation

The rate for superannuation contributions by employers on behalf of their employees under the SGC for the year ended 30 June 2018 is 9.5%.

Employers must make superannuation guarantee contributions for their employees on a quarterly basis within 28 days after the end of each quarter (September, December, March and June)

Small business entities

Is the taxpayer eligible to be a small business entity? i.e. for 2017/18 annual turnover less than $10 million (aggregated with connected entities and affiliates).

Benefits of being a small business entity include:

- Small business CGT concessions (subject to a lower turnover threshold)

- Simplified depreciation rules

- Accelerated write off of assets (see budget announcement above)

- Simplified trading stock regime

- 100% deduction for certain prepaid expenses

- Two-year amendment of assessment period

Income received in advance

Income received in advance may not be derived (and taxed) until the services are provided. Income received in advance should be credited to an unearned income account. This rule will generally not apply if payment is not refundable if services are not provided.

Income received in advance must be released to profit when services are provided, or if services are not provided, when it is determined the services will not be provided and no refund is claimed by customer.

Timing of services

Expenses are generally deductible if incurred by 30 June 2018. This requires a presently existing liability and provisions are generally not deductible.

Some accruals are not deductible. There are specific rules that determine when some expenses are deductible (in particular, see prepayment rules below). Interest paid after a business ceases may be deductible.

Repairs

Incur repairs on or before 30 June 2018 to obtain the deduction in the 2017/2018 income year, but they must not be:

- Initial repairs

- Substantial replacement of an asset

- Improving an asset

Gifts

- Donate to deductible charities before 30 June 2018

- Ensure the payment is to an endorsed deductible gift recipient (DGR)

- Donations are not deductible if a benefit is received by the donor, unless the contribution was made at eligible fundraising event for a DGR and the contribution is more than $150. The deduction will be reduced by value of any benefits received at the event

- GST inclusive value of benefits received must not exceed lesser of 20% of contribution and $150.

Bad debts

- Review bad debts before 30 June 2018

- Remember the rules for deducting bad debts

- Write-off bad debts before year end to get deduction in that year (provision for doubtful debts not deductible)

- Bad debts may not be deductible if there has been a change in ownership or control of a company or trust (unless company passes the same business test).

Trading stock

- Consider an appropriate valuation method - you can choose cost, market selling value or replacement price

- Identify any obsolete stock – special valuation rule

- Scrap unwanted stock by 30 June 2018

- If taxpayer is a small business entity, stock valuation is not required if the difference between opening and estimated closing value of trading stock for the year is $5,000 or less.

Home office expenses

Home office expenses may be deductible where you carry on business or employment activities at home. A portion of interest, rent and insurance are not deductible unless you are carrying on business from home and the area is separate and distinguished from private living areas. If you are carrying on a business from home, deductibility of interest, rent etc. may be determined by the space occupied by the home office, as well as extent the space is used for income producing purposes. Converting the spare room is not sufficient to be classified as a home office.

Power, heating and depreciation can be claimed at a flat rate established by the Tax Office even if the room is not exclusively set aside for a home office

If an office is provided by the employer, working from home as a convenient place to do part of the work may not be sufficient to claim home office expenses.

There have been a number of recent Tribunal cases looking at the deductibility of home office costs. This issue has been identified by the Tax Office as a risk area that may be subject to increased audit activity.

Car expenses for individuals

- If claiming actual expenses, check the log book is current and that log book details are correct. Check out our article on the log book method for details.

- Ensure year end odometer readings are taken

- Ensure all relevant receipts have been kept

Personal deductions

Individuals who are seeking to claim deductions for employment-related expenditure should be aware of an increase in audit activity by the Tax Office in relation to personal employment related deductions.

When you are claiming these deductions, you should ensure:

- You are actually entitled to claim the deduction (is the amount deductible?)

- You can substantiate the expenditure you are seeking to deduct (do you have the appropriate receipts, tax invoices, diaries etc.)

- Have you restricted your deduction to the business/employment related portion of the deduction (have you excluded the private/non-deductible amounts and can you substantiate business/employment use)?

Prepayments

- If expenses are not subject to the prepayment rules, prepay deductible expenditure by 30 June 2018

- The prepayment rules spread a pro-rated deduction over more than one year, where the expenditure provides benefits after end of the current income year

- The prepayment rules do not apply to excluded expenditure, which includes:

- Salary

- Amounts required to be paid by law or a court

- Expenditure under $1,000.

- Small business entity taxpayers and non-business individuals are allowed prepayments in the year incurred if the benefit does not extend beyond 12 months.

Taxable payments reporting system

Businesses in building and construction are required to record payments to contractors and report these payments to the Tax Office. The annual report due to be lodged by 21 July 2018.

In the May 2017 Federal Budget, the Government announced they intended to extend the scheme to cover payments to contractors in the cleaning and courier industries. At the time of writing, these amendments have not been legislated.

Super guarantee and contractors

Employers need to ensure they make super contributions for all eligible employees, including certain independent contractors for Superannuation Guarantee Charge ('SGC') purposes.

Under SGC, 'employee' includes individuals who are employees in the ordinary sense (PAYG) and independent contractors engaged under a contract primarily for the provision of labour.

Where you engage contractors, you should review the contracts to determine whether the individuals are treated as employees for SGC purposes.

Depreciation

- Scrap all obsolete items by 30 June 2018 to claim undepreciated cost

- Consider reassessing the effective life if the asset has excessive use

- Balancing adjustment on disposal – excess assessable or deficit deductible – rollover is available

- Consider delaying disposal of items for a profit until after 30 June and bringing forward disposal of items for a loss to before 1 July

- Plant costing less than $1,000 - option to allocate assets to a low value pool:

- Depreciated at diminishing rate value of 37.5%

- First year rate 18.7% diminishing value

- New low value assets must go into low value pool.

- The replacement cost of items costing less than $100 each can be deducted in the conduct of a business where the items have a short life and may be subject to breakage or loss

Depreciation for small businesses

- Small businesses can claim an immediate deduction for assets they start to use or install ready for use, where the asset costs less than $20,000

- The $20,000 threshold will apply to assets acquired and installed ready for use between 12 May 2015 and 30 June 2019

- A small number of assets are not eligible for the immediate write-off, including horticultural plants and in-house software allocated to a software development pool. In most cases, specific depreciation rules apply to these assets

- Assets valued at $20,000 or more may be placed in the small business depreciation pool and depreciated at 15% in the first year, and 30% in subsequent years

- The pool can be immediately deducted if the balance falls below $20,000 over the period (including existing pools).

If you have any questions about any of these tips, please contact us as soon as possible.