Budget 2018 Edition

In this edition:

Taxation: Individuals

Medicare Levy Rate

As part of the 2017/18 Federal Budget, the Government proposed to increase the Medicare levy rate to 2.5% from 1 July 2019. This proposal has now been reversed and the Medicare levy rate will remain at 2%.

Goodwin Chivas & Co Commentary

A nice win by keeping the rate the same as it is today.

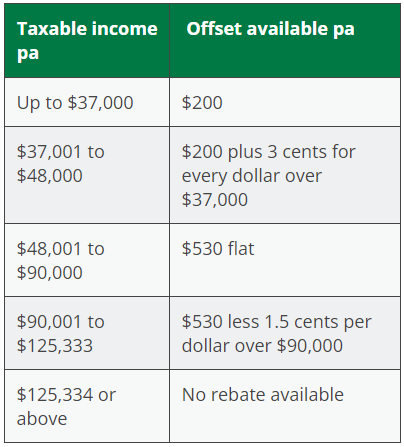

Low and Middle Income Tax Offset and Low Income Tax Offset

In addition to the existing low income tax offset, the Government will introduce the low and middle income tax offset which will apply from the 2018/19 financial year to the 2021/22 financial year inclusive. The offset will be applied on a tiered basis as outlined in the table below.

From 1 July 2022, the low income tax offset will increase from $445 to $645. This offset will reduce by 6.5 cents for every dollar over $37,000 up to $41,000 for an offset of $385. From $41,000, the offset reduces at 1.5 cents resulting in no offset applying for incomes in excess of $66,667.

Goodwin Chivas & Co Commentary

The low and middle income tax offset is a temporary measure to provide 'immediate relief'. Once this new tax offset ends however, the implementation of the changes to the low income tax offset and marginal tax rates should provide ongoing relief.

With the additional low and middle income tax offset, the effective income tax-free threshold will be lifted from the current $20,542 to $21,595.

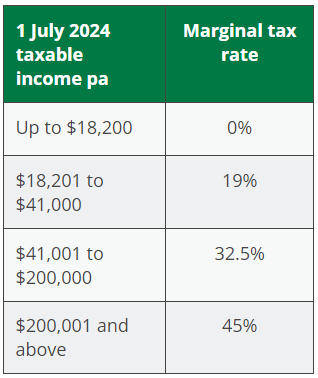

Changes to the Marginal Tax Rates

There are a number of proposed changes to marginal tax rates over the next seven years:

- From 1 July 2018 the 32.5% upper threshold is proposed to increase from $87,000 to $90,000.

- From 1 July 2022 the 32.5% upper threshold is proposed to increase from 90,000 to $120,000 and the 19% threshold is proposed to increase from $37,000 to $41,000.

- From 1 July 2024, the 32.5% upper threshold is proposed to increase from $120,000 to $200,000 and the 37% tax rate is proposed to be removed.

The top marginal rate will also be extended to taxable income exceeding $200,000. The marginal rates would be as per the below table:

Goodwin Chivas & Co Commentary

Overall the combined impact of these changes is to simplify the marginal tax rate system and reduce the amount an individual pays in tax. However, the next seven years will see added complexity for individuals when estimating their tax returns as well as changes to PAYG deductions

Please contact us for advice or assistance relating to these changes.