February 2016 Edition

In this edition:

Fuel tax credit rates - Changes from 1 February 2016

With the 2016 financial year well under way and the lodgement deadline for December 2015 quarter BAS fast approaching we would like to make businesses aware of the changes to the fuel tax credit regime.

The changes to the rates apply to fuel purchases acquired from 1 July 2015. With changes to rates on the following dates also: 1 August 2015 and 1 February 2016.

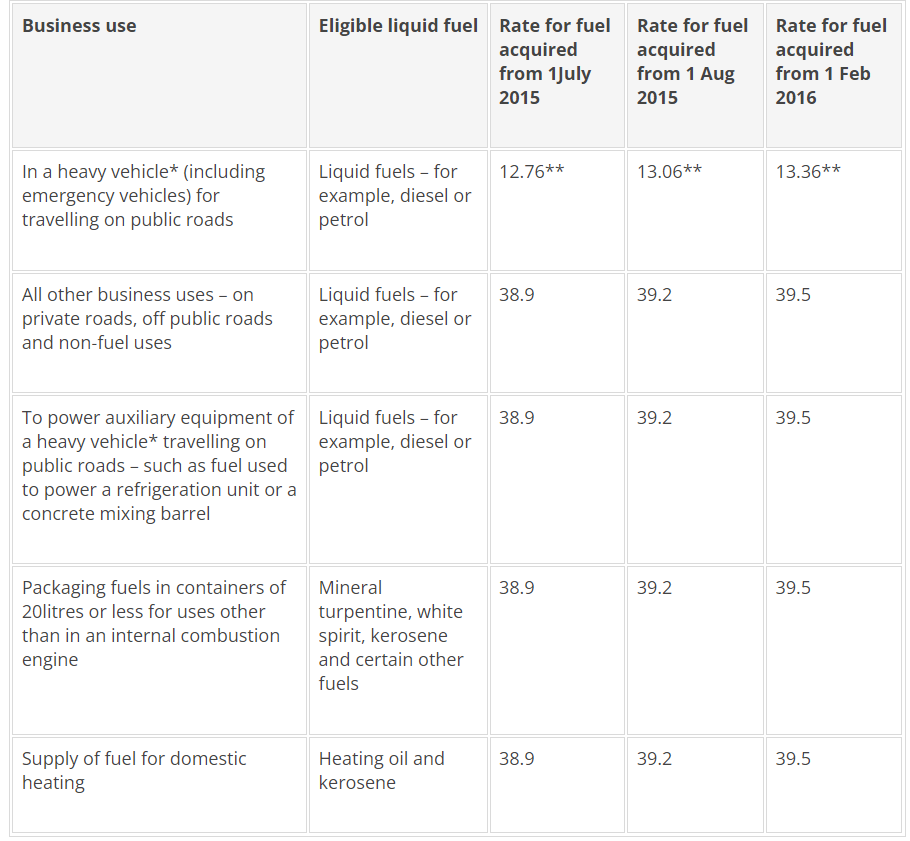

These changes are summarised in the below table from the ATO website:

* A heavy vehicle is a vehicle with a gross vehicle mass (GVM) greater than 4.5 tonnes. Diesel vehicles acquired before 1 July 2006 can equal 4.5 tonnes.

** This rate accounts for the road user charge (which is subject to change) and applies to fuel used in a heavy vehicle for travelling on public roads.

With the changes to the rates it is important to use the correct rate when claiming the fuel tax credit entitlement. The fuel tax credit rate in effect on the date the fuel was acquired must be used in claiming fuel tax credits. This may not be the rate in effect when you use the fuel or claim your fuel tax credits on your business activity statement (BAS).

The rate change does not specifically impact the December 2015 quarter BAS (due 29th February 2016). However, if you have used the incorrect rates and you are entitled to additional credits you can claim the extra fuel tax credits in the December 2015 or future BAS.

Contact us at Goodwin Chivas & Co if you have any queries or require any assistance.

Contact details

Suite 401 29-31 Solent Circuit

Norwest Business Park

Baulkham Hills, NSW 2153 Australia

View location map

P:

(02) 9899 3044

F: (02) 9899 1524

About Us

Our Team Members are the heart and soul of our business. Our team's guiding principles are integrity, respect, teamwork, achievement and innovation. Our guiding principles are the keys to our culture and to achieving our vision.

Resources

We offer a range of free and easy to use

online resources and tools including...