September 2015 Edition

In this edition:

New ATO penalty regime for SMSFs

Additional powers to force compliance

The penalty regime for self-managed superannuation funds (SMSFs) under the Australian Taxation Office (ATO) has been in place since 1 July 2014. The ATO was recently handed additional powers to force compliance by SMSF trustees with their duties and obligations. The new regime allows the ATO to issue three different types of notices.

- A Rectification Notice – this involves specific action be taken by the trustee within a specified time frame to rectify a contravention.

- An Education Notice – this requires a person to undertake a specified course of education within a certain time, and give the ATO evidence of completion. No fee may be charged for the course and any cost incurred in undertaking the course cannot be reimbursed or paid from the fund – trustees must pay the costs out of their own pockets.

- An Administrative Penalty Notice – for breaches of certain sections of the SIS Act, a penalty notice may be issued to either individual trustees or a corporate trustee.

The first two of these listed below will impose additional costs and time requirements on trustees. The third notice will be used most often by the ATO and imposes large penalties on the trustees. Where a SMSF has individual trustees the ATO will impose a penalty on each individual trustee meaning the penalty will be multiplied by the number of trustees. Corporate trustees will incur only 1 penalty.

From 31 July 2015, penalty units have increased from $170 to $180 per penalty unit and will apply to all contraventions that take place from this date.

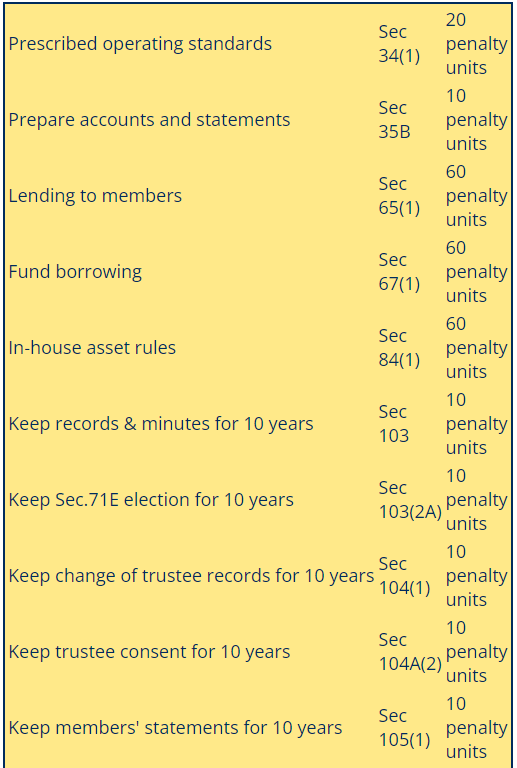

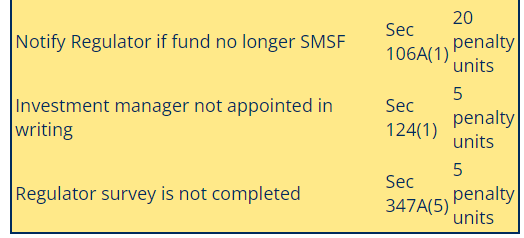

See the below table for the administrative penalty units:

To illustrate this, if you as the trustee of the fund lend money to a member of the fund you will be personally liable to penalties of $10,800 ($180 x 60 penalty units).

Trustees must be even more vigilant in their record keeping and in the transactions which the fund undertakes. If you are in doubt about a transaction or investment you are about to undertake in your SMSF please do not hesitate to contact us or your financial advisor.