October 2015 Edition

In this edition:

Why we should focus on beyond 2016

Important information for businesses

Payroll tax is a state/territory based tax payable by employers. Generally, employers are required to self-assess their liability to payroll tax on a monthly basis, which is then reconciled at the end of each financial year. Employers are required to register for payroll tax if during any one month their total Australian wages or the group's total Australian wages exceed the relevant monthly deduction threshold level.

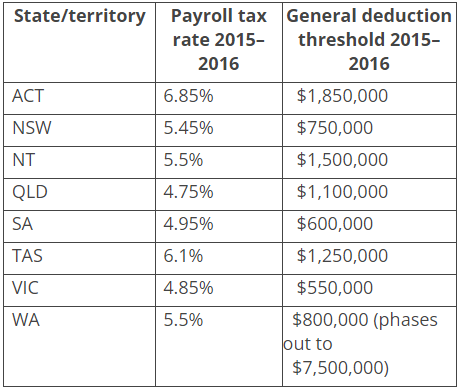

Payroll tax is calculated on wages and salaries paid (or payable) by an employer to its employees and deemed employees per the below table. Payroll tax only becomes payable by an employer or group when the total of all wages paid exceeds a general deduction threshold:

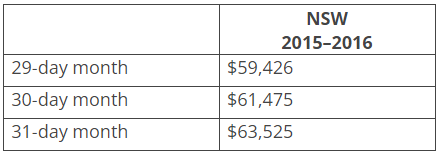

Each state and territory also has a monthly threshold which is 1/12th the annual threshold. The exception to this is New South Wales and Tasmania (which have different thresholds for 28-day, 30-day and 31-day months). For New South Wales the monthly thresholds are as follows:

The definition of wages is very wide yet there are some items that are excluded, including the following:

- maternity or adoption leave paid in addition to normal leave entitlements;

- payments made under the Paid Parental Leave scheme;

- the income tax free portion of redundancy or early retirement payments; and

- certain payments made by an insurer, and compulsory Workers Compensation payments.

Note that these rules apply at the group level. In our next month's newsletter we will explore how the grouping provisions work.

Please contact your Goodwin Chivas manager or partner if you would like to discuss this matter further in regards to your specific affairs.

Contact details

Suite 401 29-31 Solent Circuit

Norwest Business Park

Baulkham Hills, NSW 2153 Australia

View location map

P:

(02) 9899 3044

F: (02) 9899 1524

About Us

Our Team Members are the heart and soul of our business. Our team's guiding principles are integrity, respect, teamwork, achievement and innovation. Our guiding principles are the keys to our culture and to achieving our vision.

Resources

We offer a range of free and easy to use

online resources and tools including...