March 2015 Newsletter

In this edition:

Protect your family from life's surprises

by Debbie Adams

A recent survey conducted for the Financial Services Council by Rice Walker found that only 4% of those with dependants have sufficient life insurance (1). This has the potential to greatly affect families who aren't covered if one parent were to die.

Sufficient life insurance is generally accepted to be at least 10 times the insured's earnings. But alarmingly, six in ten people with dependants don't have enough life insurance cover to look after their loved ones for more than one year if they were to die (2).

Having been in the finance industry for a number years, I believe these alarming results could be due to a lack of awareness about the types of life insurance solutions available and the cost of purchasing cover.

Many people insure their home and their car, but fail to insure their most important asset, their ability to produce an income, which is also their life. People fail to realise the value of their 'working' life. It supplies the capital that fuels the lifestyle that you and your family enjoy, not just now, but well into the future.

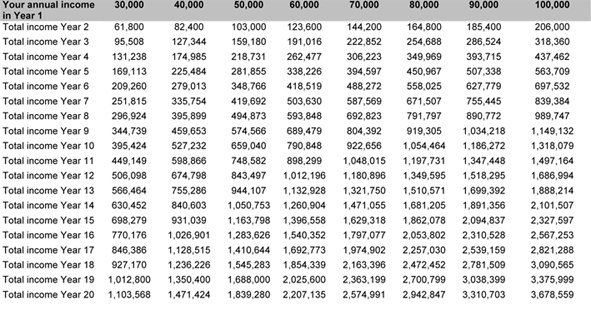

The table below demonstrates just how valuable an 'asset' your ability to produce an income is. It shows your potential earnings over 20 years and takes into account annual CPI increases (3% pa) and pay increases (3% pa). The table represents your gross income, cumulating over time.

Even an annual income of $30,000 today is potentially worth more than $1 million in 20 years time. Imagine no longer having access to that potential income - through injury, illness or death - which is so vital to you and your family.

Who wants to be a millionaire?

There are many insurance products available that come under the 'life insurance' umbrella. So understandably, trying to evaluate the best product to protect your family can be daunting, and I recommend seeking professional assistance when choosing a life insurance policy.

I would encourage anyone who does not have some sort of life insurance to make an appointment with my office for a comprehensive risk management assessment. Those with life insurance, but who have not updated their policy recently, could also be at risk. Life changes such as marriage, the birth of a child, or purchase of a house all impact your life insurance needs.

Contact Debbie Adams on 02 98993044 to make an appointment to assess your insurance needs.

Important Note:

This material is of a general nature only and has been prepared without taking into account your objectives, financial situation or needs. Before making a decision based on this material, you should consider the appropriateness of this material in regards to your objectives, financial situation and needs.

__________

(1) FSC-Rice Walker Fast Facts: a nation exposed!

(2) FSC-Rice Walker Fast Facts: a nation exposed!

Contact details

Suite 401 29-31 Solent Circuit

Norwest Business Park

Baulkham Hills, NSW 2153 Australia

View location map

P:

(02) 9899 3044

F: (02) 9899 1524

About Us

Our Team Members are the heart and soul of our business. Our team's guiding principles are integrity, respect, teamwork, achievement and innovation. Our guiding principles are the keys to our culture and to achieving our vision.

Resources

We offer a range of free and easy to use

online resources and tools including...