February 2015 Newsletter

In this edition:

Super changes in 2015

A brief summary of some of the key changes to be aware of this year

Increase in Preservation Age

One of the most important modifications to superannuation this year is the increase in the preservation age, which is the age from which you can begin to access super. If you are planning for retirement or pre-retirement, these changes will need to be factored in.

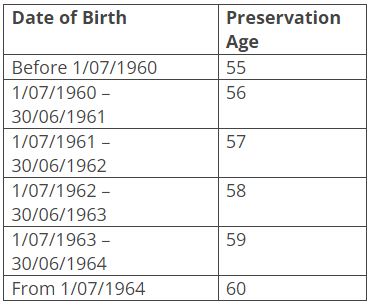

Currently if you are born before 1 July 1960, you are able to start drawing an income stream from super when you turn 55. But from the middle of this year, anyone born between 1 July 1960 and 30 June 1961 will have to wait until they turn 56 before they can access super.

In addition, over each of the next five years the preservation age is set to increase by a year in 12-month increments as indicated in the table below.

SuperStream

Super Stream is a government initiative to streamline the communication of contribution information between employers and funds. We had previously advised of the roll out of super stream for large employers, that is employers with greater than 20 employees. If your SMSF receives contributions from an employer with fewer than 20 employees, then SuperStream will become effective from 1 July 2015.

An employer that is required to comply with the SuperStream data standard will need to identify the electronic service address for all funds in which contributions on behalf of employees are paid into. The electronic service address identifies where contributions are to be sent and allows your SMSF to receive data messages associated with employer contributions that have been sent using SuperStream.

It is recommended that employer's start to collect this information in order to ensure that they are ready by 1 July 2015.

Contact us for more information on what you need to do to ensure your fund is compliant by the 1 July deadline.

Find out more via the ATO website.

Proposed changes to excess contributions tax

Reforms to excess contributions tax are currently before Parliament and if passed, the amendments will enable individuals the option of withdrawing contributions in excess of the non-concessional contributions cap and 85% of the earnings. If you choose this option, no excess contributions tax will be payable and any related earnings will be taxed at your marginal tax rate. That's quite a difference to the current system that can apply a tax of up to 93%. And, the changes apply retrospectively to excess contributions from the 2013/2014 financial year. We will keep you up to date on the progress of these reforms.

If you are a GCC client, your GCC representative will keep an eye on this if it relates to you.

If you have any questions about how these changes relate to you please contact your GCC representative.