'Ace in the Hole': Budget 2023-2024

The ‘ace in the hole’ of the 2023-24 Federal Budget was the $4.2bn surplus; the first in 15 years.

The surplus was driven by a surge in the corporate and individual tax take. High commodity prices, inflation, and high employment have all pushed up corporate and individual tax receipts.

But the gains can't be relied on long term. The Budget is expected to deliver a deficit of $13.9 billion in 2023-24, and a $35.1bn deficit in 2024-25.Most funding appears to be a reallocation of previous Government initiatives. And, the commodity-driven $54.4 billion improvement in tax receipts has largely been banked, not spent.

Individuals & families

Energy price plan relief – From July 2023

$1.5bn has been provided over 5 years to provide targeted energy bill relief and progressing gas market reform.

The Energy Bill Relief Fund will provide targeted energy bill relief to eligible households and small business customers, which includes pensioners, Commonwealth Seniors Health Card holders, Family Tax Benefit A and B recipients and small business customers of electricity retailers.

In partnership with the states and territories, the plan is expected to deliver up to $500 in electricity bill relief for eligible households and up to $650 for eligible small businesses.some fairly bracing economic expectations:

Household energy upgrade fund

A $1.3bn Household Energy Upgrades Fund will be established to support home upgrades that improve energy performance. No, the Government is not giving out cash for upgrades but providing $1bn to the Clean Energy Finance Corporation to provide low-cost finance and mortgages in partnership with private financial institutions for home upgrades that save energy.

$300m is committed to upgrading social housing in collaboration with states and territories. And, over $36m to upgrade the energy ratings systems.

Incentive to provide Medicare bulk billing to concession card holders and children – From July 2023

As previously announced, the bulk billing incentive benefits for consultations for Commonwealth concession card holders and patients aged under 16 years of age will be tripled from 2022-23.

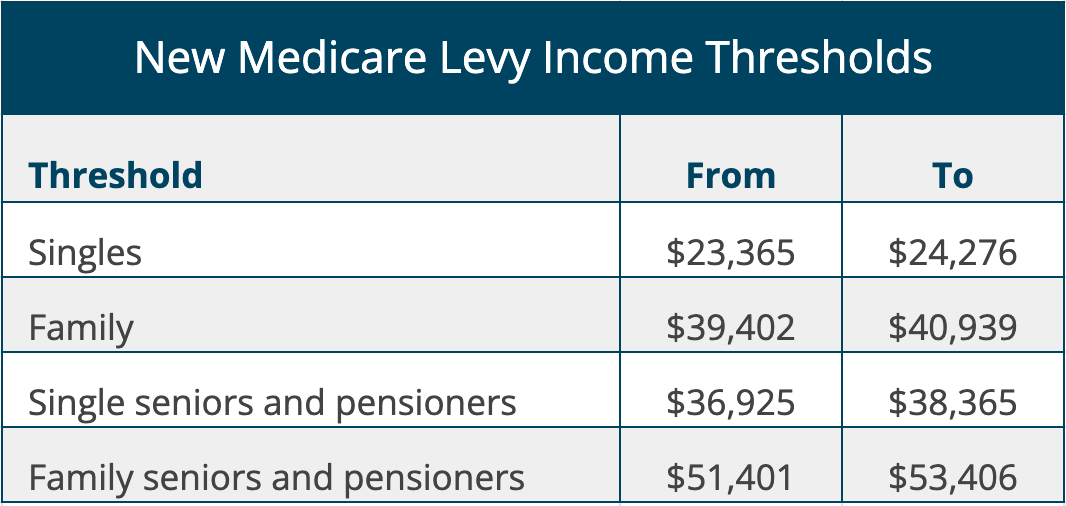

Less people to pay Medicare Levy

The Medicare levy low-income thresholds for singles, families and seniors and pensioners will increase from 1 July 2022.

For each dependent child or student, the family income thresholds will increase by a further $3,760 instead of the previous amount of $3,619.

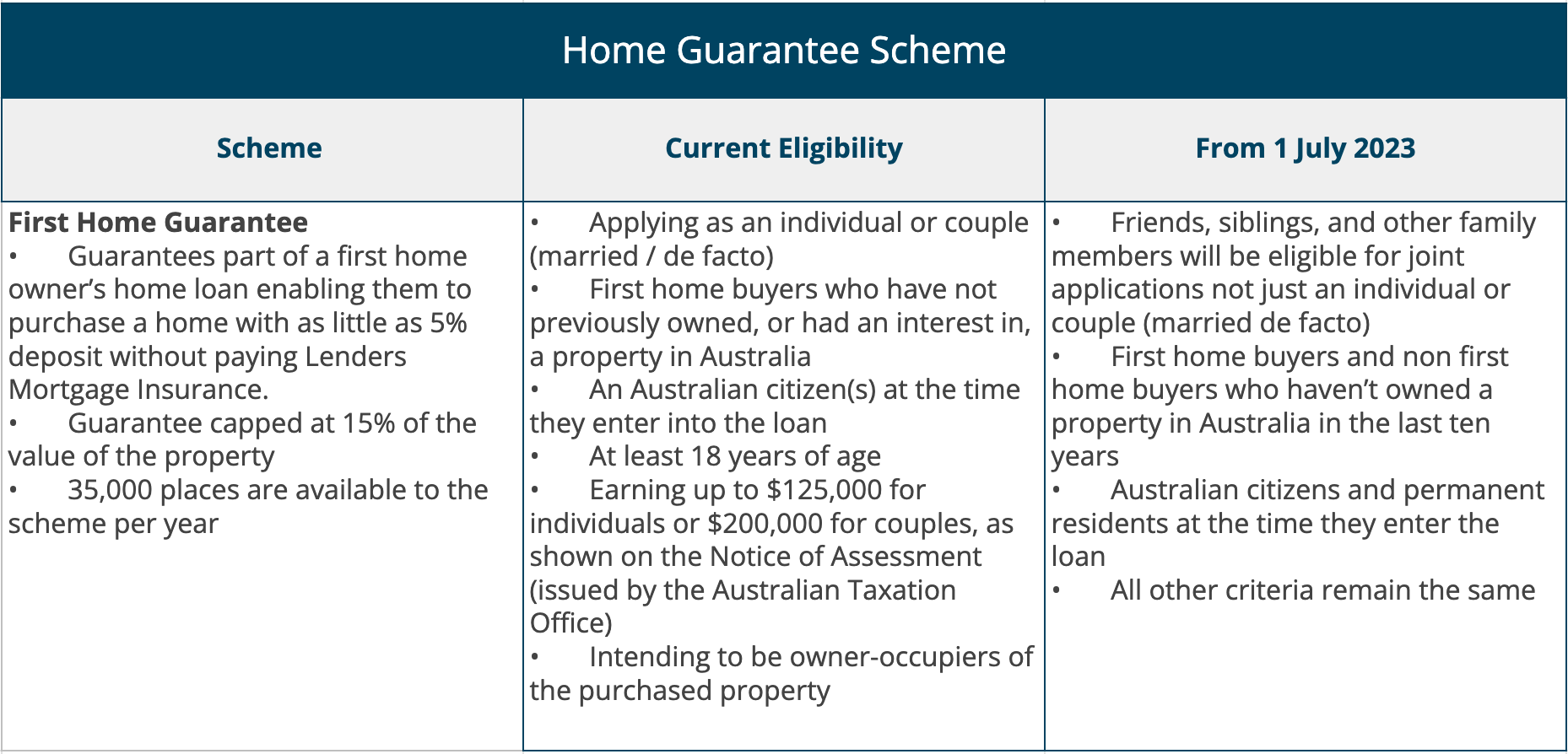

Access to home guarantee scheme expanded to friends and siblings

As previously announced, from 1 July 2023, access to the Government’s Home Guarantee Scheme will be expanded to joint applications from “friends, siblings, and other family members” and to those who have not owned a home for at least 10 years.

The Home Guarantee Scheme (HGS) is an Australian Government initiative to support eligible home buyers to purchase a home sooner. The Scheme is administered by the National Housing Finance and Investment Corporation (NHFIC) on behalf of the Australian Government.

The guarantees had previously been restricted to people that were married or in a de‑facto relationship, in addition to single applicants.

Superannuation & Investors

Confirmed 30% tax on super earnings above $3m – From 1 July 2025

An additional tax of 15% on earnings will apply to individuals with a total superannuation balance over $3 million at the end of a financial year from 1 July 2025. The definition of total superannuation balance (TSB) for the new tax uses the current definition and includes amounts in retirement phase pensions.

The calculation for the tax aims to capture growth in TSB over the financial year allowing for contributions (including insurance proceeds) and withdrawals. This method captures both realised and unrealised gains, enabling negative earnings to be carried forward and offset against future years.

Interests in defined benefit schemes will be appropriately valued and will have earnings taxed under this measure in a similar way to other interests.

Individuals will have the choice of paying the tax personally or from their superannuation fund and those with multiple accounts can nominate which fund will pay the tax.

Annual minimum pension payments

There was no mention of continuing the current 50% reduction in minimum pension payments beyond 1 July 2023, so these will return to normal levels in 2023/24.

You need to make sure funds have enough cash to pay much higher pension amounts next year. Or there may be some members considering extra payments now (above the minimum required for 2022/23) who decide to hold off until July 2023 to make up some of next year’s payments.

Total Super Balance increase

There had been murmurings that the Government might freeze the transfer balance cap so that it wasn’t indexed (increased) from $1.7m to $1.9m from 1 July 2023 in line with current legislation. No announcements presumably mean that increase will go ahead as planned.

Remember that even when the standard transfer balance cap is increased, not everyone will have a transfer balance cap of $1.9m – some people will stay on $1.6m or $1.7m and others will receive just some of the $200,000 increase.

Businesses and employers

$20,000 small business instant asset write-off – From 1 July 2023 to 30 June 2024

Small businesses, with an aggregated turnover of less than $10 million, will be able to immediately deduct the full cost of eligible depreciating assets costing less than $20,000 that are first used or installed ready for use between 1 July 2023 and 30 June 2024.

“Immediately deductible” means a tax deduction for the asset can be claimed in the same income year that the asset was purchased and used (or installed ready for use).

If the business is registered for GST, the cost of the asset needs to be less than $20,000 after subtracting the GST credits that can be claimed for the asset. If the business is not registered for GST, it is $20,000 including GST.

The write-off applies per asset, so a small business can deduct the cost of multiple assets.

Assets valued at $20,000 or more (which cannot be immediately deducted) can continue to be placed into the small business simplified depreciation pool and depreciated at 15% in the first income year and 30% each income year thereafter.

This announcement effectively confirms that the temporary full expensing rules, which have provided an immediate deduction for the full cost of assets acquired from 6 October 2020, will come to an end on 30 June 2023.

Top tip: Small business entities that are considering acquiring depreciating assets with a cost of $20,000 or more and business entities with aggregated turnover of $10 million or more should keep the cut-off date in mind as 30 June 2023 approaches.

$20,000 small business incentives for energy efficiency - From 1 July 2023 to 30 June 2024

As previously announced, the Small Business Energy Incentive provides an additional deduction of 20% of the cost of eligible depreciating assets that support electrification and more efficient use of energy.

Up to $100,000 of total expenditure will be eligible, with a maximum bonus deduction of $20,000. The incentive is available to small and medium businesses with aggregated annual turnover of less than $50 million.

Incentive likely inclusions and exclusions

While the full detail of what qualifies for the incentive is not yet available, it is expected to apply to a range of depreciating assets and upgrades to existing assets such as electrifying heating and cooling systems, upgrading to more efficient fridges and induction cooktops, and installing batteries and heat pumps.

Some exclusions will apply including electric vehicles, renewable electricity generation assets, capital works, and assets that are not connected to the electricity grid and use fossil fuels.

Eligible assets or upgrades will need to be first used or installed ready for use between 1 July 2023 and 30 June 2024 to qualify for the bonus deduction.

‘Payday’ super: Increasing payment frequency of employee super – From 1 July 2026

As previously announced, from 1 July 2026, employers will be required to pay their employees’ super guarantee entitlements on the same day that they pay salary and wages. Currently, SG is paid quarterly.

The Government will undertake a consultation process with the aim of providing details of the final design of the measure in the 2024-25 Federal Budget.

Franked distributions funded by capital raisings revised start date – From 15 September 2022

In 2016-17, the Government announced that it would seek to prevent shareholders from taking advantage of franking credits attached to dividends that are funded by capital raisings. The Budget confirms the Government’s intention to pursue this measure with a revised start date of 15 September 2022.

Under the measure, a distribution (dividend) paid by an entity will be treated as being funded by capital raising if:

- The distribution is not consistent with an established practice of the entity of making distributions of that kind on a regular basis;

- There is an issue of equity interests in the entity; and

- It is reasonable to conclude, having regard to all relevant circumstances, that either:

- The principal effect of the issue of any of the equity interests was to directly or indirectly fund all or part of the distribution; or

- An entity that issued or facilitated the issue of the interests did so for a purpose of funding all or part of the distribution.

The proposed changes seek to prevent the use of artificial arrangements where capital is raised to fund the payment of franked dividends to shareholders and therefore enable the distribution of franking credits. The Government is concerned that these arrangements can involve a manipulation of the system to allow existing shareholders to obtain the benefit of both the franking credits and the profits that generated those credits being retained in the company.

Small business lodgment penalty amnesty

Small businesses with an aggregated turnover of less than $10m, will be able to access a lodgment penalty amnesty program. The amnesty will remit failure-to-lodge penalties for outstanding tax statements lodged in the period from 1 June 2023 to 31 December 2023 that were originally due during the period from 1 December 2019 to 29 February 2022.

Do you have questions? We're here to help.

Please let us know if we can assist you to take advantage of any of these Budget measures or risk-protect your position

-

email us or phone or friendly team on

02 9899 3044.

As always, we’re here if you need us!