Shuffling the Deck: 2022-2023 Budget 2.0

It's that time again! There is nothing in this week's Federal Budget that would create a UK-style crisis. The Stage 3 tax cuts legislated to commence on 1 July 2024 are not mentioned.

Most funding appears to be a reallocation of previous Government initiatives. And, the commodity-driven $54.4 billion improvement in tax receipts has largely been banked, not spent.

With only seven months before the 2023-24 Budget is released in May 2023, this Budget is a shuffling of the deck, not a new set of cards. And to continue the pun, we need to play the hand we have been dealt, buffeted by externalities – war, floods, and global uncertainty. Read on for our summary of the budget essentials.

Tough economic conditions to continue

Cost of living pressures will continue. While some initiatives such as the increase in childcare subsidies will help, the Budget flags some fairly bracing economic expectations:

- Inflation is expected to peak at 7.75% in the December quarter and will persist at higher rates for longer than anticipated before easing to 3.5% by June 2024.

- Real GDP is forecast to grow to 3.25% in 2022-23, then retract to 1.5% in 2023-24.

- Electricity prices are expected to increase nationally by an average of 20% in late 2022, with retail electricity prices expected to rise by a further 30% in 2023-24.

- The deficit sits at $36.9bn and while this is better than estimated, it will expand to $49.5bn by 2025-26.

Tight labour market conditions are expected to see annual wage growth rise to 3.75% by June 2023. Even so, high inflation is likely to result in a fall in real wages over 2022-23 before rising slightly over 2023-24. While your wages may increase, the gains will be eaten away by the increasing cost of living.

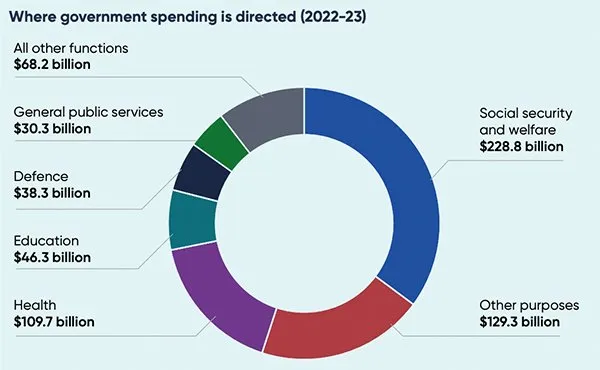

Total revenue and spending

Total revenue for 2022-2023 is expected to be $625.0 billion. Total expenses are expected to be $650.9 billion. Source: Budget Papers Appendices.

Tax compliance

The ATO gets an extra $80m to extend its personal income tax compliance program, with $674m anticipated in increased receipts and over $80m in increased payments as a result. Tax deductions will be closely watched.

As expected, multinationals are a target. New measures will limit opportunities to shift taxable profits offshore. And the ATO’s Tax Avoidance Taskforce is projected to deliver a whopping $2.8bn in additional tax receipts and $1.1bn in payments over four years.

Individuals and families

Child Care Subsidy increase – from 2022-23

As previously announced, the maximum Child Care Subsidy (CCS) rate will increase from 85% to 90% for families earning less than $80,000.

Subsidy rates will then taper down one percentage point for each additional $5,000 income until it reaches zero per cent for families earning $530,000.

The current higher CCS rates for families with multiple children aged five or under in child care will be maintained, with higher CCS rates to cease 26 weeks after the older child’s last session of care or when the child turns six years old.

Paid parental leave reforms – from 1 July 2023

As previously announced, from 1 July 2023, the Government will introduce reforms to make the Paid Parental Leave Scheme flexible for families. This means either parent can claim the payment and both birth parents and non-birth parents are allowed to receive the payment if they meet the eligibility criteria.

Parents can also claim weeks of the payment concurrently so they can take leave at the same time.

Paid parental leave eligibility will be expanded with a new $350,000 family income test, under which families can be assessed if they do not meet the individual income test.

From 1 July 2024, the Government will begin expanding the scheme from the current 18 weeks by two additional weeks a year until it reaches a full 26 weeks from 1 July 2026. Both parents will be able to share the leave entitlement, with a proportion maintained on a “use it or lose it” basis, to encourage and facilitate both parents to access the scheme and to share the caring responsibilities more equally. Sole parents will be able to access the full 26 weeks.

Seniors and pensioners

Encouraging pensioners back into the workforce – from 2022-23

Age and veteran pensioners will be able to work and earn more before their pension is reduced, with the Government providing a one-off $4,000 credit to their Work Bonus income bank.

The temporary income bank top-up will increase the amount pensioners can earn in 2022–23 from $7,800 to $11,800 before their pension is reduced, supporting pensioners who want to work or work more hours to do so without losing their pension.

The Work Bonus increases the amount an eligible pensioner can earn from work before it affects their pension rate.

Under the current rules, the first $300 of fortnightly income from work is not assessed or counted under the pension income test.

The Work Bonus operates in addition to the pension income test-free area. When the work bonus is not used in a fortnight, it accumulates in an income bank where the standard maximum is $7,800. This allows pensioners who work on an ad hoc basis to not be disadvantaged compared to those with regular fortnightly income.

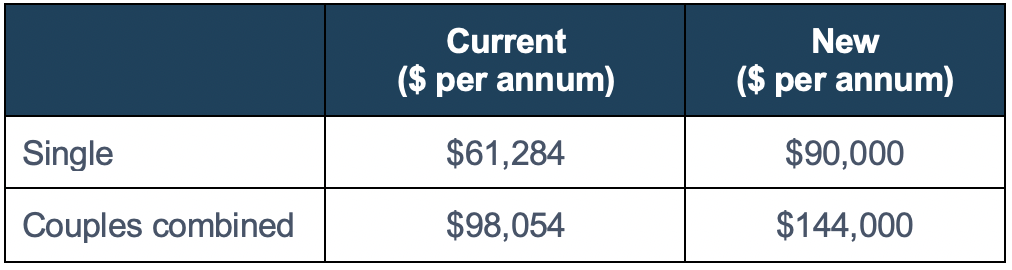

Lifting the income limit on Seniors Health Card

As previously announced, increased income test limits will apply to the Commonwealth Seniors Health Card (CSHC) - see the below table for details.

The CSHC provides subsidised pharmaceuticals and other medical benefits for self-funded retirees that have reached aged pension age.

The income test captures adjusted taxable income plus deeming on account-based pensions unless grandfathered under the pre-1 July 2015 rules. The CSHC is not asset tested. Legislation enabling the increase is before Parliament.

Superannuation

‘Downsizer’ eligibility reduced to 55 - from the first quarter after Royal Assent

As previously announced, the Government will reduce the age at which an individual can make a ‘downsizer’ contribution to superannuation from the current 60 to 55 years of age.

Currently, eligible individuals aged 60 years or older can choose to make a ‘downsizer contribution’ into their superannuation of up to $300,000 per person ($600,000 per couple) from the proceeds of selling their home.

Downsizer contributions can be made from the sale of your principal residence in Australia that you have owned for the past ten or more years. These contributions are excluded from the age test, work test, and your total superannuation balance (but not exempt from your transfer balance cap). Legislation enabling the expanding eligibility for downsizer contributions is currently before Parliament.

Businesses and employers

Energy efficiency grants for SMEs - 2022-23 financial year

The Government will provide $62.6m over three years from 2022-23 to help small and medium businesses fund energy-efficient equipment upgrades. The funding will support studies, planning, equipment and facility upgrade projects that will improve energy efficiency, reduce emissions, or improve power demand management. No details of the grants are currently available.

Small business skills and training boost

Businesses with an aggregated turnover of up to $50 million will be able to deduct an additional 20 per cent of expenditure incurred on external training courses provided to their employees.

Small business technology investment boost

Businesses with an aggregated turnover of up to $50 million will be able to deduct an additional 20 per cent of expenditure (capped at $100,000) incurred on business expenses and depreciating assets that support digital adoption. Examples include subscriptions to cloud-based services, cyber security systems and portable payment devices.

Businesses may continue to deduct expenditure that is ineligible for the bonus deduction under the existing tax law. Further details on eligible expenses will be available once the law has passed.

Export support

$80.0 million over four years from 2022-23 to provide additional support for small and medium export businesses to re-establish their presence in overseas markets through the Export Market Development Grants program.

Please let us know if we can assist you to take advantage of any of these Budget measures or risk-protect your position

-

email us or phone or friendly team on

02 9899 3044.

As always, we’re here if you need us!