December 2017 Edition

In this edition:

Are you eligible for the low Company Tax Rate?

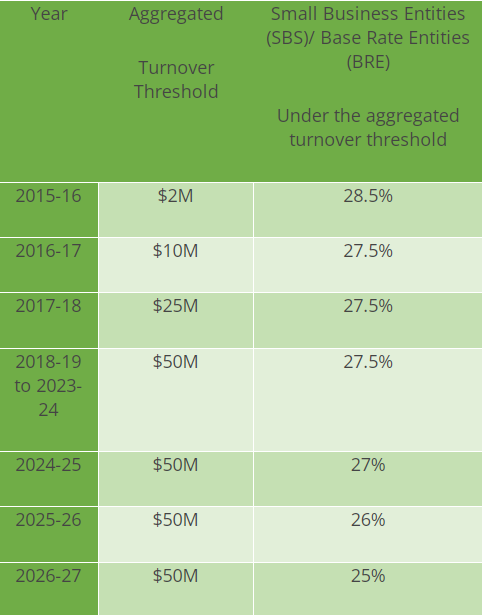

Many of you may already know that a company will be eligible to the lower 27.5% tax rate if it carries on a business and meet the aggregated turnover requirement. Under the current law the following corporate tax rates apply.

For 2016-2017 Income Year – Under Current Law

For 2016-17 income year companies carrying on business with aggregated turnover of less than $10 million is eligible for the lower corporate tax rate (27.5%) under current law. Note that the maximum franking credit that can be allocated to a distribution is the same as the corporate tax rate for the current income year (i.e. 27.5%)

Carrying on a business

To be eligible to the lower tax rate companies must pass the 'Carrying on Business Test'. Recently ATO has issued a draft Taxation Ruling (TR2017/D7) to clarify the meaning of carrying on business test. It states a number of factors should be considered in determine whether a company is carrying on a business:

- the nature of the company's activities and whether they are intended to be profit making

- company's intention to carry on a business

- the degree of repetition and regularity of the company's activities, including whether the activities are carried on in a business-like manner, and

- the size and scale of the company's operations

Generally where a company is established and maintained to make a profit for its shareholders, and invests assets in gainful activities that have both a purpose and prospect of profit, it is likely to be carrying on a business. For example a company invests in a commercial rental property and makes a profit, or a company holds portfolio of listed shares and generates profit carries on a business.

The Government has introduced the Treasury Laws Amendment (Enterprise Tax Plan Base Rate Entities) Bill 2017 which is proposed to replace the 'carry on business test' with new 'passive income test' the draft Ruling only has relevant to the 2016-17 and earlier income years.

For 2017-18 Income Tax Year – Under Proposed Amendments

On 18 October 2017 the Government introduced the Treasury Laws Amendment (Enterprise Tax Plan Base Rate Entities) Bill 2017 into Parliament. If passed, the eligibility for lower company tax rate for 2017-18 income tax year is only available to companies with no more than 80% base rate entity passive income and have an aggregated turnover less than the relevant threshold.

Base Rate Entity Passive Income

Under the proposed law the base rate entity passive income includes:

- A dividend where recipient company holds <10% of voting power in company paying the dividend

- Franking credits attached to that distribution

- Interest income, royalties and a rent

- A net capital gain

Income from trusts or partnerships, to the extent it is referable (either directly or indirectly) to an amount that is otherwise base rate entity passive income.

For example, Investment Co only receives rental income in 2017/18 year is a passive investment company as all the income is base rate entity passive income, Investment Co's corporate tax rate is 30% regardless it's turnover level in that year.

Conclusion

As there are no proposed changes to the law for 2016-17 income year companies are encouraged to lodge their tax returns under the current law. Companies require an ongoing assessment whenever there are changes in the activity and status of the company.

Please contact your Goodwin Chivas & Co team member for further information.