The importance of asset diversification

We have all heard stories of that one person who made the big bucks buying that one lucky stock that took off, or holding an array of rental properties in the same town. The majority of the things we hear about involve large amounts of risk for a seemingly low initial return.

Not everyone has large sums of capital to throw into the next big tech stock, or the financial stability to invest in one single asset class without putting the remainder of their wealth at risk (gearing). The base of the discussion here is your risk tolerance as an investor; this is your ability to see through the ups and downs in a portfolio.

Diversification is something we have all heard about, however, it seems we tend to stick to single assets as everyday investors because we may not understand the benefits associated with diversification.

Lowering risk

The number one reason for diversifying is that it lowers your overall risk. The more you spread your assets out, the less likely it is that a single event will negatively impact your portfolio.

If you have all of your investments in a single stock and that stock loses 50 percent of its value over the course of a year, you've just lost 50 percent of your portfolio. But if that stock only makes up 3 percent of your portfolio, a 50 percent drop-off won't affect you as much (1.50%)

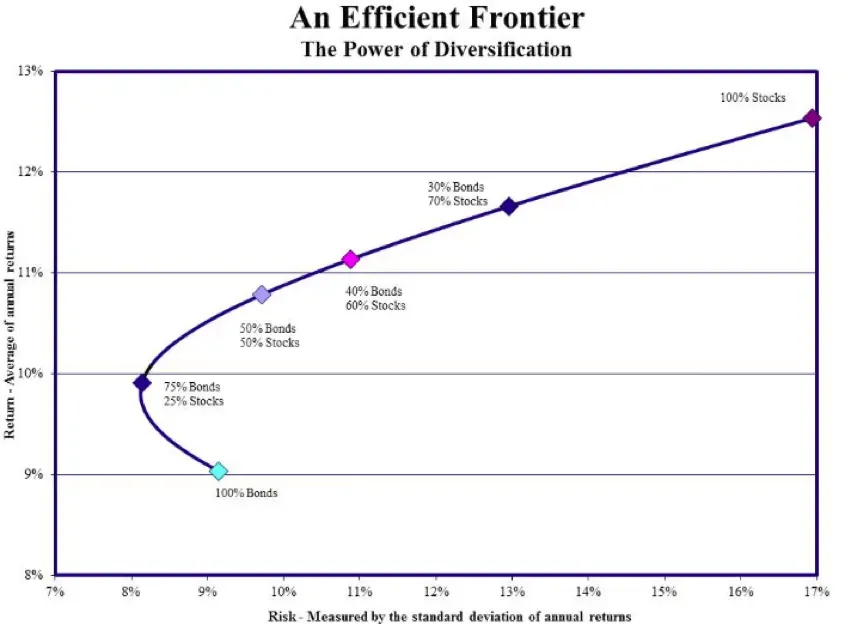

The Graph below shows how diversification of growth and defensive assets affects the total return of the portfolio in relation to level of risk. Please note, the bond returns used in the graph are based on the Merrill Lynch 7-10 year US Treasuries index and the stocks used in the graph below are based on total return of the S&P 500 index from 1977-2011.

New opportunities

Ultimately, diversification opens you up to more opportunities. This satisfies our natural "fear of missing out", whereby we regret not having invested in a particular investment after the investment has performed well.

The idea is that we expose our capital to multiple sectors of the economy in order to smooth out risk exposure and also increase opportunity or exposure to sectors which are experiencing growth.

Risk tolerance and portfolio diversification

Risk tolerance goes hand in hand with your goals for investment. Therefore, setting a goal for your funds is important in deciding the amount of risk you want to take in our portfolio. Having a diversified portfolio needs to be considered if you are looking to reach these goals over multiple market cycles.

Diversification is not fun as it's an expression of humility, an admission that things will not always go right when investing. However, it strives to smooth out non-systematic risks of investing across a range of opportunistic investments where the positive returns of one asset over one period of time will neutralise the negative performance of others.

If you wish to discuss diversification of your assets and your tolerance for risk, please don't hesitate to contact our offices for more information.

This information is of a general nature only and has been provided without taking account of your objectives, financial situation or needs. Because of this, you should consider whether the information is appropriate in light of your particular objectives, financial situation and needs.