July 2013 Newsletter

In this edition:

New ATO determination on correcting GST mistakes

Effective from 10 May 2013New Paragraph

On 10 May the Australian Taxation Office issued a new Determination on correcting GST mistakes. This Determination sets out the circumstances under which the ATO will allow taxpayers to correct a GST error in the next Business Activity Statement (BAS) they lodge in circumstances where the error was made in a previous BAS.

Where GST errors are corrected in the next BAS to be lodged in accordance with the requirements of the Determination, no penalties or general interest charges will apply.

What is an error?

The Explanatory Memorandum that accompanies the Determination provides the following examples of what can constitute a GST error:

- clerical errors such as failing to include the GST payable on a taxable supply or reporting GST payable on taxable supplies twice;

- understating or overstating the GST payable, for example, entering GST sales as $10,800 rather than the correct amount of $10,000;

- overstating or under claiming an input tax credit for a creditable acquisition; or

- omitting, understating or overstating an increasing or decreasing adjustment.

Correcting a GST credit error

Credit errors are no longer subject to value or time limits and may be corrected in the next BAS lodged provided:

- the errors are corrected within the applicable 4 year review period; and

- the tax period in which the error was made is not subject to ATO compliance activity.

A failure to claim an input tax credit in the period that it is available is of itself not an error within the terms of the Determination. This is because input tax credits can be claimed in a later tax period through the normal application of the GST Act. For example, a situation where a taxpayer discovers a valid tax invoice from 12 months ago that has not been included in any previous BAS is not an error.

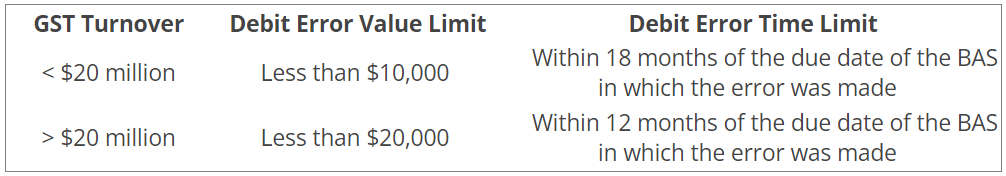

Correcting a GST debit error (that is GST payable)A debit error can be corrected in the current BAS providing the following conditions are satisfied:

- the tax period in which the error was made is not subject to ATO compliance activity;

- the error was not a result of recklessness or intentional disregard of a GST law; and

- the error was made within the debit error time and value limits as provided in the below table:

If you have any questions about how this information impacts you, please contact us on 02 9899 3044.