April 2013 Newsletter

In this edition:

Workers Compensation

Part 2: Which contractors do I need to cover?

(Read Part 1: Workers Compensation Insurance in NSW from our March newsletter)

Any person who has entered into, or who works under, a contract of service or a training contract could be a person that needs to be considered and covered for workers compensation.

As a general rule if a person is entitled to receive workers compensation benefits in the event they have a work related injury then the person is considered a worker and payments made to them will need to be included for the purposes of calculating the employers workers compensation premium.

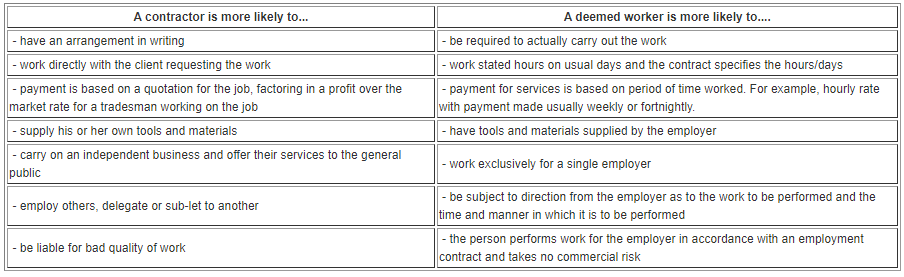

As a general rule:

Myths about contractors for Workers Compensation

The person has an ABN and invoices for work

While these indicators are taken into account, on their own they are not conclusive indicators that the person is not a worker. The whole of the relationship must be taken into account.

The person works for others:

A person can be a worker for more than one employer. While this is one indicator, the whole of the relationship must be taken into account. This is particularly the case where the work for others is only conducted either on weekends or outside of their regular working hours.

80/20 rule:

This is a taxation rule only. This is not considered for workers compensation purposes. It is important to note that the definition of worker for workers compensation purposes is different than that for income tax purposes.

The person carries sickness and accident insurance:

Carrying another form of insurance does not extinguish any workers compensation liability an employer may have for a person who is considered a worker or deemed worker.