April 2016 Edition

In this edition:

Valuing SMSF assets

New tax affects property, shares and trusts

The Superannuation Industry Act (SIS Act) requires SMSF trustees to report superfund assets at market value when preparing year-en financial reports. ATO have released valuation guidelines and will generally accept your determination of an asset's value, as long as:

- It does not conflict with market valuation for tax purposes.

- There is no evidence that a different value was used for the corresponding capital gains tax event

- It was based on objective and supportable data.

When and what type of valuation needs to be undertaken?

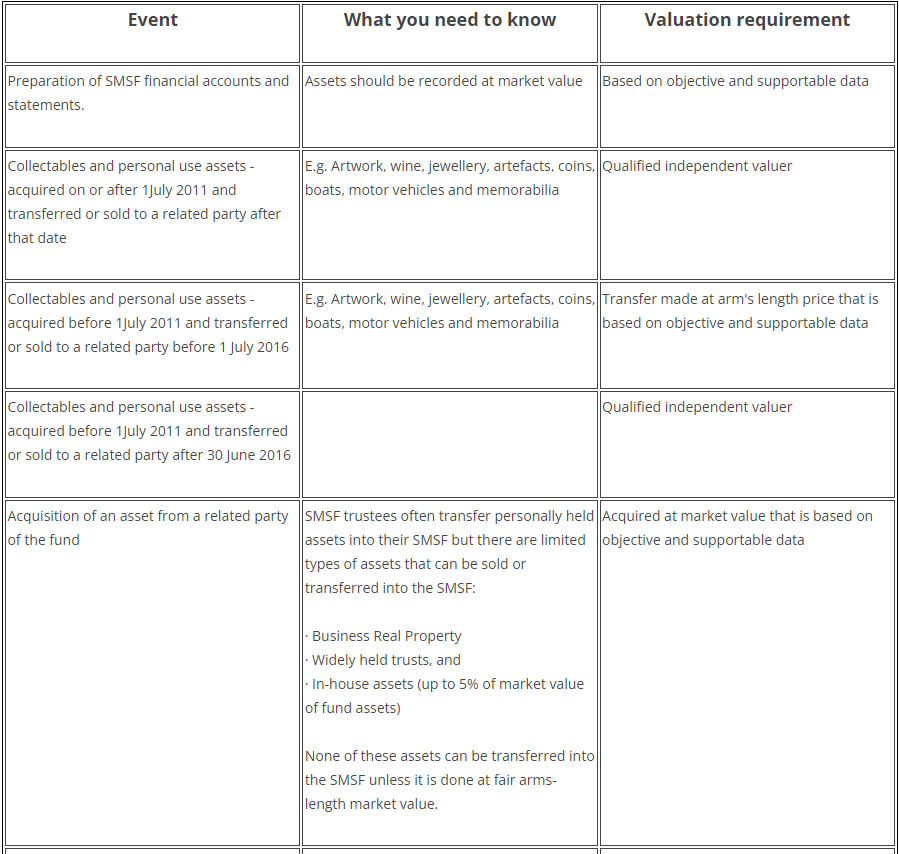

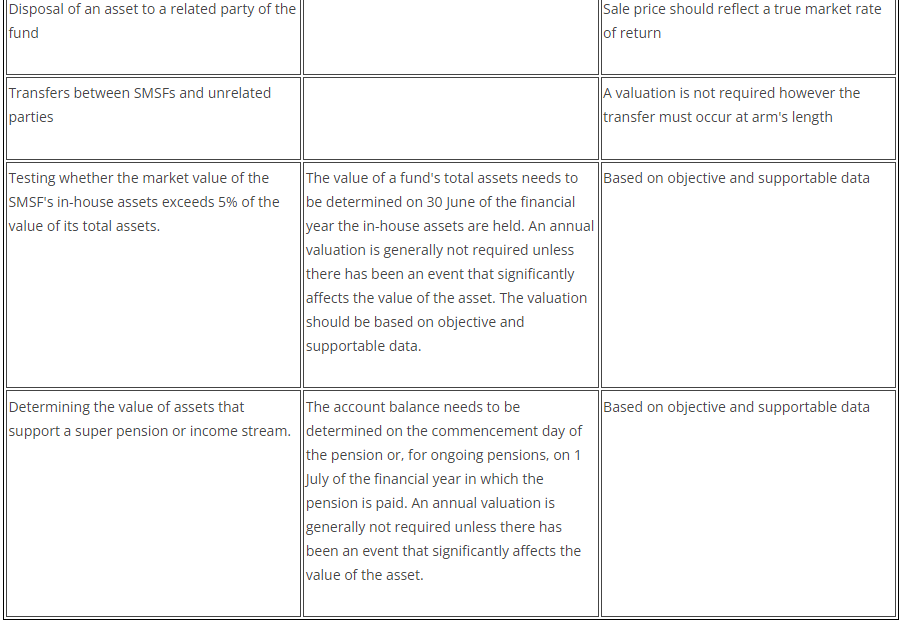

The following chart extracted from the ATO valuation guidelines and provides a simple summary on the various valuation requirements:

Who can conduct the valuation?

Depending on the situation, a valuation may be undertaken by a:

- registered valuer

- professional valuation service provider

- member of a recognised professional valuation body

- person without formal valuation qualifications but who has specific experience or knowledge in a particular area.

The guidelines indicate that, broadly speaking a valuation will be acceptable if it can be demonstrated that a fair and reasonable process has been used. For year-end reporting purposes, the ATO has stated that in most cases, the valuation can be undertaken by anyone as long as it is based on objective and supportable data.

However, the ATO has recommended a qualified independent valuer be used if an asset represents a significant portion of the funds value or the nature of the assets would mean that the valuation would be complex or difficult.

The ATO guidelines have stated that it would be acceptable for a real estate valuation to be undertaken by a property valuation service provider as long as it is based on objective and supportable data, including online services or a real estate agent.

How often does a valuation need to be undertaken?

The value of assets should be given consideration annually, however this may not require a re-valuation each year. Assets such as cash and listed securities that are easily valued would be required to be valued at the end of every year. Other assets such as real estate may not need to be revalued each year, although a significant event occurring during the year may require a new valuation to be undertaken at year-end.

For more detailed information, please refer to the ATO Valuation Guidelines for SMSF's. For any queries around SMSF valuations please contact your GCC team member.

Contact details

Suite 401 29-31 Solent Circuit

Norwest Business Park

Baulkham Hills, NSW 2153 Australia

View location map

P:

(02) 9899 3044

F: (02) 9899 1524

About Us

Our Team Members are the heart and soul of our business. Our team's guiding principles are integrity, respect, teamwork, achievement and innovation. Our guiding principles are the keys to our culture and to achieving our vision.

Resources

We offer a range of free and easy to use

online resources and tools including...